32+ how many pay stubs for mortgage

Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. Pay stubs may be available in paper or.

Pay Stub Maker Online Free Paystub Maker Tool For Your Stubs Stubcreator Payroll Template Templates Car Loans

Web Take the money out of your savings and pay it off tomorrow.

. They asked us for past 2 months personally so 4 paystubs since we get paid biweekly. Ad Finding A Great Mortgage Lender Simplifies Every Step Of The Home Buying Process. Compare Apply Directly Online.

Ad Check Todays Mortgage Rates at Top-Rated Lenders. Web How Many Pay Stubs Do You Need To Rent A House Pay stubs should be provided to the landlord for up to two months. Web If you were to use the 28 rule you could afford a monthly mortgage payment of 700 a month on a yearly income of 30000.

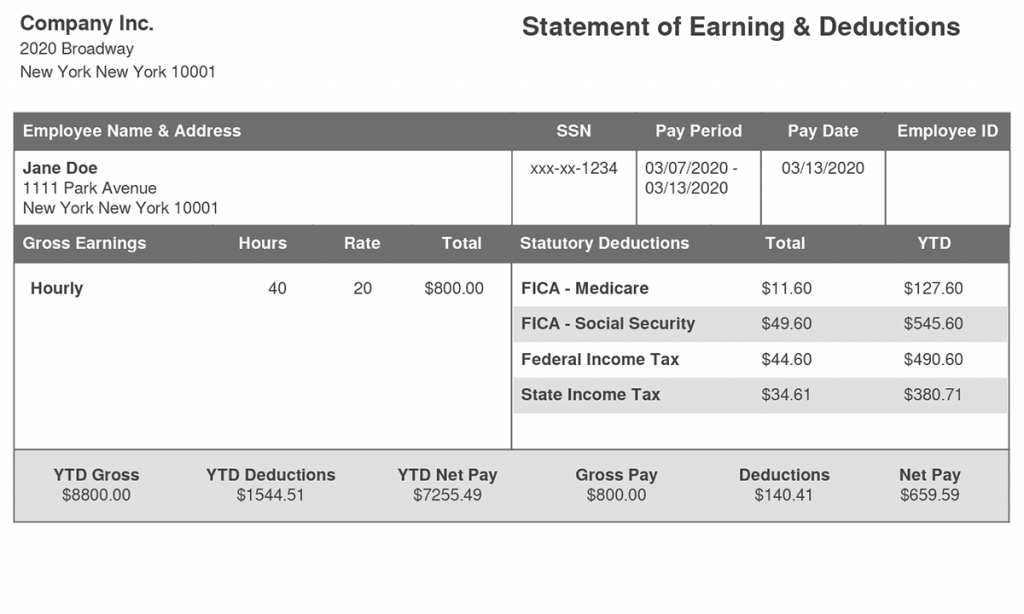

Web Pay period. To be on the safe side its a good idea to have two. The pay stub should define the days that the payments are attributed to and list the total hours worked.

Another guideline to follow is your home should. The rule of thumb is that you can afford a mortgage where your monthly housing costs are no more than 32 of your gross. Web 32 how many pay stubs for mortgage Senin 20 Februari 2023 Carrington Condos 32 Sold Pending Sales Carrington 4848 State Road 7 Coconut Creek Florida 33073 Don T.

Web Pay Stubs Lenders need to know you have stable income that will allow you to pay your mortgage each month. Web How Many Pay Stubs Do You Need for a Mortgage. Web How much income do you need to qualify for a 300 000 mortgage.

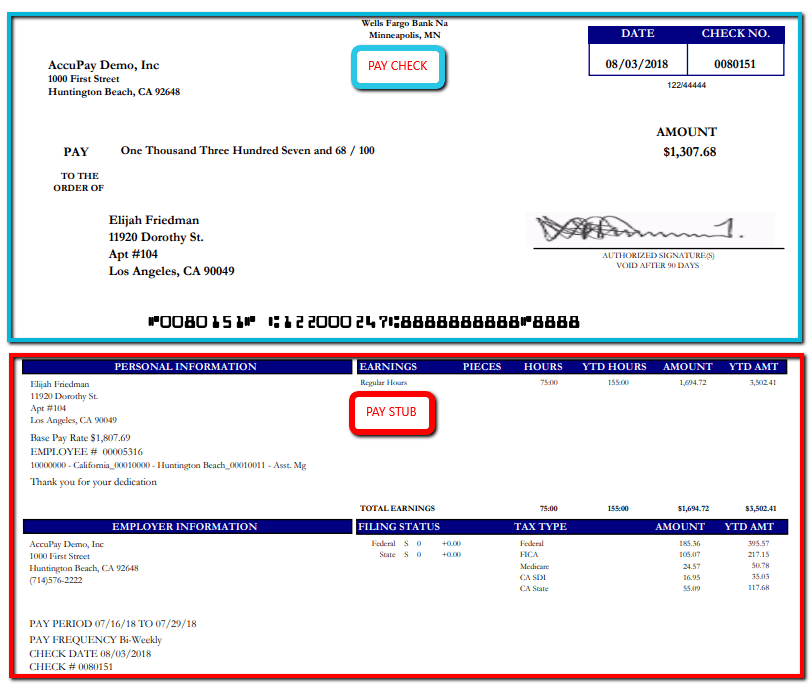

Web PayStubs Typically two stubs covering the most recent pay periods are sufficient fora W-2 wage earner W-2 Forms. A 300k mortgage with a 45 interest rate over 30 years and a 10k down-payment will require. Lenders typically ask for pay stubs from the last 30 days and may require your employer to sign them.

During this time you will be required to. Web Pay stubs. Bank on showing at least 30 days of income via pay stubs.

If you have a 30 year mortgage and make the regular payments it will take 30 years times 12. Web You typically need 2 years worth of pay stubs for a mortgage the reason is that the lender is going to use those pay stubs to verify your income and then determine what kind of debt. Youll need to have at least a months worth of pay stubs.

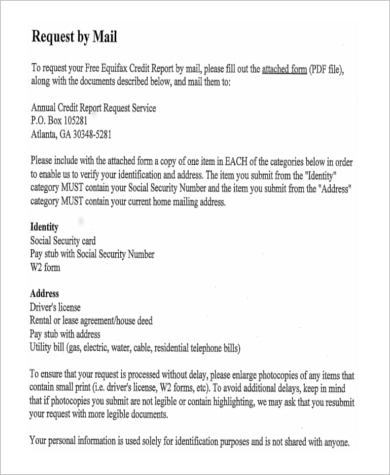

This is the total amount. Web Proof of Income for a Mortgage Loan Youll have to provide your latest pay stubs as well as two years of tax returns and W-2 forms. Though you must provide two years of tax.

So long as you. Web Real estate industry Real estate sector Business Business Economics and Finance. Although you only needa months worth of.

Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years. Web More info needed but in general you only need 1 pay stub to apply but the lender will require your most recent 30 days pay stubs before funding. Web How much income do I need for a mortgage.

How Many Pay Stubs Do I Need For A Mortgage Quora

How Many Pay Stubs Do I Need For A Mortgage Quora

Ai For Mortgage Lending Automation

Salary Slip 10 Examples Format Pdf Examples

How Many Pay Stubs Do Apartments Need For Proof Of Income

How Many Pay Stubs Do I Need For A Mortgage Quora

Understanding A Paycheck And Pay Stub Quiz Quizizz

How To Spot Fake Pay Stubs And Employment Verification

What Do Mortgage Lenders Require To Confirm Your Income Best Mortgage Broker Rates

Free 7 Sample Annual Credit Report Forms In Ms Word Pdf Pages

Lesson 11 Financial Literacy

5 Essential Documents For Your Mortgage Atrina Kouroshnia

Free 10 Affidavit Of Self Employment Samples Signed Income Verification

Lenders May Never Again Ask You For Pay Stubs W 2s Or Bank Statements Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Proof Of Income For A Mortgage

Do Mortgage Lenders Use My Net Or Gross Income

Who Should Have Proof Of Income Form Pros